This essay outlines how business entities began and grew to become the recognizable ancestors of modern business. It suggests that deliberate innovation and marketing are the principal distinctions between modern and ancient business, and argues that finance, although important even in antiquity, has become vastly more so today because of techniques that greatly increase the trustworthiness of borrowers.

Irritated one day about a management error at my company, I said to myself “this place is run like a Roman blacksmith’s shop!” That stopped me, as I realized that I knew nothing of Roman blacksmith shops, or even if they had them (they did). From that moment I wanted to know how business began, what business was like in its early times, and how much it has changed.

Businesses are not just entities that trade or manufacture. Governments, charities, farmers, and others have also done these things; conversely, businesses have often done things, like tax collection, that we now expect of governments. What distinguishes a business from all other entities is that it sells to voluntary customers for a profit. Businesses must attract enough customers and earn enough profit to justify the risk, effort, and investment involved in operating them. These needs determine what, where, and how businesses sell, and require urgent attention to costs, revenues, investments, and markets.

Origins

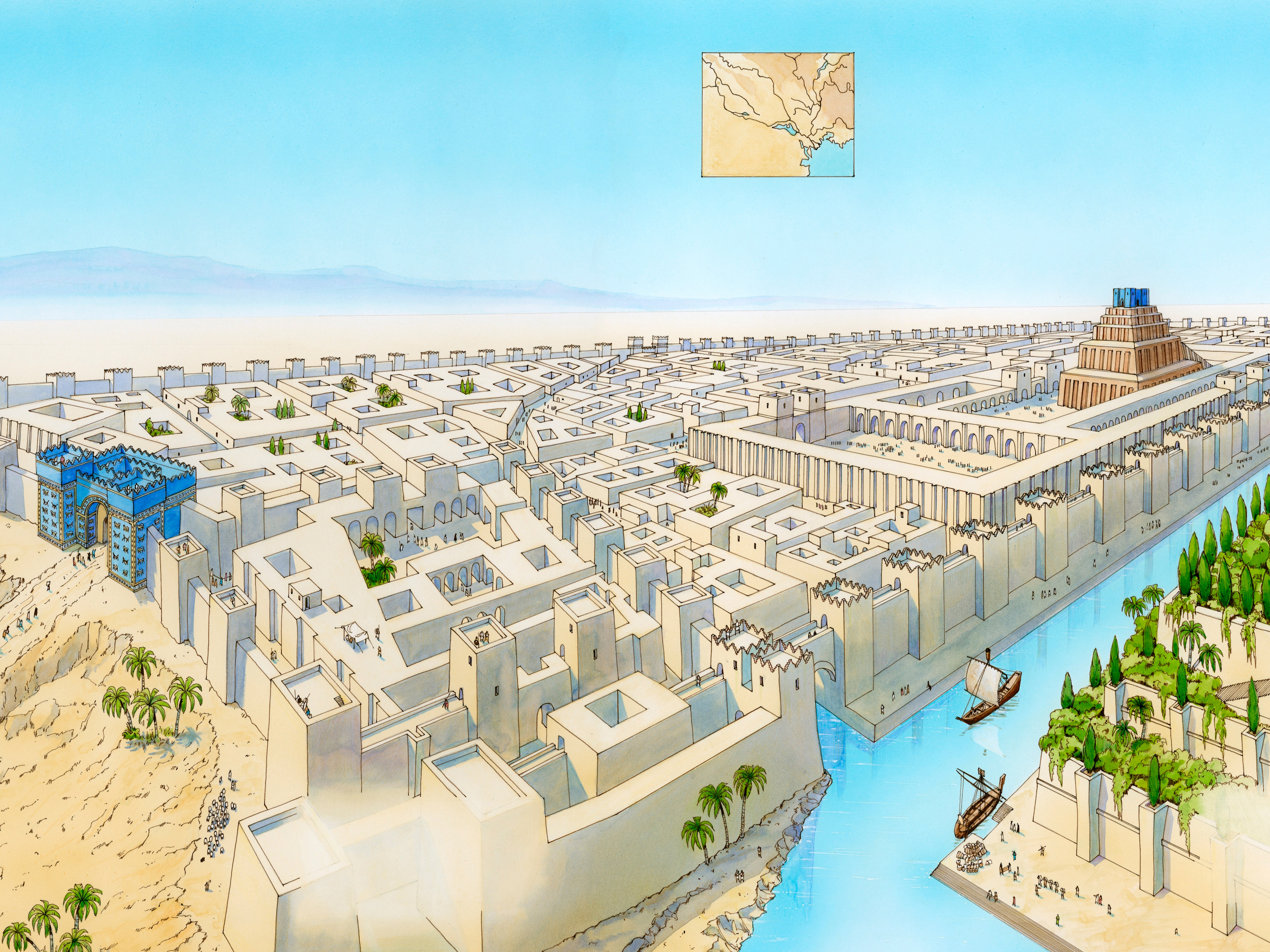

The concept of profit originated when irrigation made population concentrations possible around 3000 BCE. As these first small city-states in the marshy lands of lower Mesopotamia generated substantial and predictable surpluses, their rulers sought luxuries and conquest. With few natural resources at hand, the rulers had to import most of what they desired, and sent out long-distance traders to acquire them. These traders, highly placed relatives of the rulers, would travel long and dangerous distances to bring back wood from Lebanon, lapis lazuli from Afghanistan, gold and silver from the Caucasus and Zagros mountains, and precious stones that originated in India or further east. Keeping some of these goods for themselves, they would invest in land, slaves, or other possibilities at home. They were probably the first businessmen.

The opportunities for trade expanded as Mesopotamian rulers brought more land and people under their sovereignty, creating ever-larger free trade zones. By 2000 BCE these conquerors had created bureaucracies to perform their sovereign functions, using planning, math, accounting, and writing as management tools. These tools made it possible for businesses to deliberately calculate and pursue profit.

With the diffusion of iron technology after 1000 BCE, Assyrian, Babylonian, and especially Persian conquerors secured large territorial empires, instituted systematic tax collection, and with the proceeds provided a degree of peace and justice that legitimized their sovereignty. Prosperity and trade increased and petty barter markets arose at ports and city gates. But only Phoenician cities like Ugarit, Sidon, Tyre, and Beirut became important business centers, largely because of their trade in purple dye, silver, weaponry, and artworks.

Greece, the Hellenistic Kingdoms, and Rome

By 800 BCE, Greek city-states were rising to power and prosperity. Mostly occupying small valleys between arid mountains, their growing populations settled colonies around the nearby seas, perching, as Plato said, like frogs around a pond. Largely because of terrain, they remained politically discrete, never forming irrigation-based empires. Instead, the Greeks developed a largely free and highly militarized citizenry, which acquired a degree of wealth through mercenary service and conquest. This wealth was not heavily concentrated, and individuals freely conducted trade and other business activities.

The neighboring Anatolian kingdom of Lydia, home to the fabled kings Midas and Croesus, possessed large deposits of electrum, a varying combination of silver and gold. Seeking to hire Greek mercenaries, the Lydians discovered how to change the electrum into pure gold and pure silver, and in the 7th century BCE minted gold coins to pay them, guaranteeing purity with a stamp of the king’s symbol. Coinage rapidly spread to the Greeks, appearing in Byzantium, Athens, Ephesus, Corinth, and other Greek trading cities by the 5th century BCE. As coins replaced barter, Athenians used their enlivened markets for their necessities and luxuries, and entrepreneurs from all over vied to sell in them. Moneychangers and bankers rose to provide financial services. 4th century BCE Athens had more banks than anywhere in the Western world before Renaissance Venice.

After Alexander the Great’s death in 324 BCE, his successors established versions of the Greek market system throughout the Middle East, installing the Greek market system in all their Hellenistic kingdoms and beyond. And from these kingdoms, which it absorbed after 166 BCE, Rome took this economic system for itself. The Romans embellished it with a far sounder and more extensive monetary system, the invention of business corporations, a patronage system that financed entrepreneurial activity, large-scale agribusiness, and extensive government contracting. The emperor Augustus established the famous Pax Romana, which despite occasional breakdowns like the Jewish revolts in Judea lasted for approximately two centuries. Its peaceful conditions favored the number, profitability, and economic importance of businesses, as well as the social respectability of business owners and managers.

Unfortunately, a smallpox plague may have killed a quarter of the Empire’s population during the reign of the great emperor Marcus Aurelius (121-180 CE). Barbarian invaders followed, capturing important gold and silver mines. Constant military campaigns sapped morale, manpower, and the imperial treasury. As successive emperors coped by debasing the coinage, the reduced value of their payments to soldiers and contractors destroyed government contractors and led armies in Europe to demand in-kind payment. European markets and businesses disappeared, real estate prices fell, and outlaws and marauders proliferated. Powerful Romans acquired large estates throughout Italy, Spain, and Gaul, replaced enfeebled city councils, and offered serfdom to the peasantry in return for protection and subsistence on their estates. Despite a 4th century restoration of imperial power, these great landowners increasingly avoided taxation. By 474 CE, when the last western emperor retired, the weakened western empire was dissolving into a number of Germanic kingdoms.

In the eastern half of the empire, large and wealthy cities prevailed and often reinforced Roman coinage with their own. For that and other reasons, despite business’s loss of government custom the legacy of business, money, and markets survived into the Byzantine era and the 7th century Arab conquests.

Nature of Ancient Business

Ancient business, at its most extensive under the Romans, consisted primarily of farming and animal husbandry, exploiting natural resources (forestry, mining), manufacturing (cloth, iron tools and weapons, bricks, art, jewelry and other luxuries), real estate ventures, and trade including retailing. Major services were banking (money-changing, deposit banking, lending, investment banking), hospitality (inns, caravansaries, restaurants), and entertainment (prostitution, festivals, plays, races, gladiatorial shows).

Public contracting, often by corporations, was the largest and most profitable type of Roman business. Public contractors operated public properties (forests, fisheries, mines, and grazing grounds); brought food for public consumption to Rome and elsewhere; collected various provincial taxes; manufactured military equipment; and supplied army outposts on the frontiers. They also operated Rome’s postal system, served as banks for provinces and their dignitaries, and effectuated international payments for Roman officials.

The basic structure of ancient businesses consisted of owners and financiers, citizen and non-citizen managers, slaves and freed slaves, and, occasionally, paid employees. Each occupied a rigidly bounded social category that entailed distinctive costs and benefits, but business provided about the only non-military opportunity for the lowliest to achieve social advancement and wealth.

Questions

I would like to conclude this article by discussing two questions: what is fundamentally different about business today? And, how does the role of finance compare?

Important Differences between Ancient and Modern Business

There are plenty of obvious differences between ancient and modern businesses, including size, organizational complexity, technologies, what they sell, and the nature of work and employment. But such features, if not found in the businesses of antiquity, are still mainly intensifications or variations of what did exist. A larger difference lies in the crucial role that modern business plays in the creation of material wealth. Although that role was exemplified, for me, by the experience of ancient Athens, only in recent decades, thanks to systems of innovation and marketing that never existed in antiquity, has business become the primary source of the world’s wealth.

Prior to the Industrial Revolution, wealth consisted primarily of land and natural resources. These provided peasants with subsistence, and supported the priests and rulers, along with their slaves, soldiers and bureaucrats, and whatever luxuries, festivities, and monuments they bought. Athens and certain other Greek city-states, however, never had so much productive land – yet grew far richer, per capita, than any Middle Eastern empire. How could it be? It was mysterious; a mystery that turns out to foreshadow what makes even resource-poor nations like Japan, Holland, and Denmark wealthy today.

The reason for Athenian wealth begins with the rise of money and markets in the 5th century BCE. Newly enlivened markets exposed people to goods they had never known about, and sparked a desire for them. People who had produced only the necessities for subsistence, rent, and taxes began to seek purchasing power to satisfy those desires. The Greek culture of personal freedom allowed citizens to seek purchasing power through enterprise, deploying their skills, time, ingenuity, and assets to create and sell goods or services. The resulting purchasing power, in combined with desire (known to economists as demand), raised the general level of wealth. This process would replicate itself on a larger scale in the Hellenistic societies, and reach an ancient apogee in the Roman world during the four centuries between 200 BCE and 200 CE.

Business accounts for much more of our wealth than of antiquity’s. As the “market” is practically universal, virtually everyone desires what businesses constantly create and offer. The stimulation of demand is practically a constant. And just like in ancient Athens, it produces growing wealth, only on a far larger scale. Crucial to this constant stimulation of demand are two processes that existed only in embryonic form in antiquity: innovation and marketing.

Antiquity had innovations, but the process of innovation was haphazard, not deliberate or systematic. No infrastructure for supporting innovation existed, and any commercial use was entirely incidental. Today, however, a constant stream of new or improved products and services flows from university, government, non-profit, and business laboratories, consulting firms and corporate “skunk works” dedicated to innovation, from fundamental science to new applications. We encourage innovations through subsidies, cultural approval, and patent and trademark protections, while maintaining an educational system that prioritizes the output and dissemination of creativity.

Similarly, antiquity had marketing of a modest sort, but there was no supportive infrastructure for either its creation or its use. Retail stalls might contain signs, strolling vendors could cry their wares in the street, and there were even a few branded identities, such as wine from the Greek island of Chios, and Roman chariot-racing and gladiatorial stables. But this was insignificant by comparison to that of modern business. There was no medium for publicity, no art or science of commercial enticement, and marketing played no role in creating, shaping, or presenting what businesses sought to sell. My claim, therefore, is that modern business plays a much greater role in creating wealth, largely due to deliberate efforts at innovation and marketing.

Finance: As I have conceived it, wealth consists essentially of purchasing power, whether in the form of money, by which we mean readily exchangeable assets like coins, or of credit, an artifact of human Imagination that converts difficult to exchange assets like land, buildings, future earnings, or trustworthiness into money. Finance arose to make such conversions. To the extent that finance succeeds in this, it increases the amount of purchasing power and, hence, of a society’s wealth.

Finance began in Mesopotamia to advance tax payments against harvests, or precious metal against land mortgages. Later, the invention of money brought moneychangers, who exchanged functional coins for those of larger denomination or foreign origin. The role of finance expanded to wealth protection and management when Greek bankers accepted deposits for safekeeping, or to invest them in trade on behalf of the owners. There were even unsecured loans, essentially converting trustworthiness into money. Indeed, unsecured loans became the dominant form of finance in Rome, where patrons could rely upon the powerful social custom of patronage to assure the trustworthiness of slaves, former slaves, and other clients. Some free Romans even sold themselves into slavery to obtain capital in this way.

Assuring the trustworthiness of repayment is essential to financial activity. In antiquity, that requirement originally confined credit to family or clan members. Religious oaths, social norms, legal codes, and Roman patronage allowed trust to extend a bit further. In modern economies, though, many innovations have enormously improved the ability of creditors to determine and improve the trustworthiness of repayment. Technology, financial techniques, data systems, and portfolio management theory have made greatly increased levels of trust rational, so that finance can extend vast new amounts and terms of credit. For this reason, finance has assumed a much larger role in the creation of wealth than ever before. Those ignorant of these changes decry increased levels of debt as overly risky by historical standards. But given the centrality of purchasing power to wealth, finance legitimately occupies an increased role in modern economic life. The remedy to financial turmoil is not to roll back credit, but rather to prevent the financial community from malpractice in the exercise of its political and economic power.

About the Author

Keith Roberts is a 1968 graduate of Harvard Law School. Keith Roberts has managed firms in publishing, real estate, cosmetics, and contract manufacturing. He is currently an arbitrator in NYC, Chair of the Lawyers Conference of the American Bar Association’s Judicial Division, and the author of various articles on legal and economic issues.

Keith Roberts is a 1968 graduate of Harvard Law School. Keith Roberts has managed firms in publishing, real estate, cosmetics, and contract manufacturing. He is currently an arbitrator in NYC, Chair of the Lawyers Conference of the American Bar Association’s Judicial Division, and the author of various articles on legal and economic issues.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.