The world is constantly changing. We see it all the time. Yesterday’s league leaders become today’s relegation battlers. Alternative misfits become mainstream celebrity icons. What were once rich mines of natural resources dry up, while new sources of supply emerge in unexpected or newly explored places.

Sources of investment returns are no different. Companies and their profits are no different. Dividends are no different. What the table above shows us is that old reliable can stop being reliable, while newly explored areas can uncover gems you never knew were there.

That’s why it’s so important to make sure you systematically search every industry and every country to find companies with very valuable qualities that can lead to outperformance. Most investors don’t do this, sticking to what they are familiar with instead, which is why they don’t find them. By using a systematic and well diversified investment approach, you can find attractive stocks in places that other investors don’t. That gives you a big advantage.

Our investors expect us to outperform. That’s why we invest in companies that have good dividend yields and strong dividend growth. Why dividends? Because only companies with growing profits and healthy cash balances can increase their dividend over time. Dividends can’t be manipulated in the same way as other financial data, so they are a great way of identifying companies that are growing, as well as being reasonably priced. Because dividends are connected to cash flows and profits, a reduction can also be a strong signal that problems are looming.

Again, our investors expect us to outperform. That’s why we use a systematic and well diversified approach. We want a big set of investment opportunities which improves performance and the consistency of returns. That’s also why we avoid the very narrow risk concentrations you get at country and industry level with fundamental equity income funds. Diversification helps with consistency. Some investors think you can’t get diversification if you look for high dividends, but this is not true. Many of today’s compelling dividend companies are not in traditional or familiar places (e.g. they are not large caps, not financials and not mature defensives).

Finally, if you want to be a successful equity investor it is crucial to understand that equities are a total return asset class. This means it’s the income and price change combined that generates the return. Many investment managers think that price change is most important in this equation, but again, these people are wrong! To highlight this point, let’s look at equity returns with income and compare them to equity returns without income. And just to prove how wrong most investment managers are, let’s do it in a high growth region and keep the time horizon relatively recent. Let’s use Emerging Markets.

The chart above simply shows the return of the MSCI Emerging Market Index with income (the green line) and compares it to the index without income (the yellow line). The return DOUBLES over the twenty years. Staggering isn’t it. Even in a high growth region where most people don’t even consider the income component, dividends and income are crucially important if you want to maximise your returns. In fact they make up half the total return. “A bird never flew on one wing” is a phrase my grandmother used to use. Now we know what she meant!

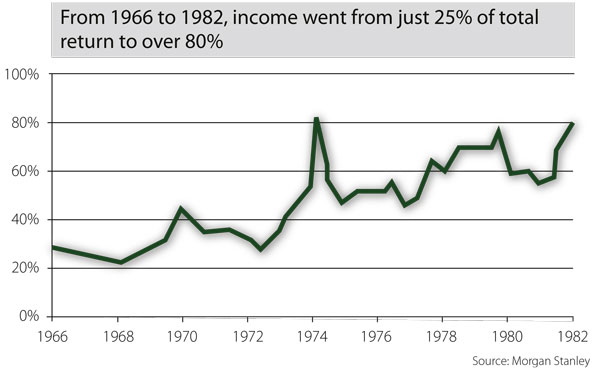

Income gets overlooked because we tend to look at equity returns on a month by month or quarter by quarter basis, when the income contribution can seem small. But because it’s always positive and gets reinvested for future growth, over longer timeframes it’s hugely powerful. (Think of how a credit card bill that you don’t pay seems to grow exponentially.) In particular, dividends can completely dominate equity returns when the economic environment is not that positive. Can it be even greater than half the total return? The chart below measures the contribution that dividends make to equity returns during a similar period of moderate growth historically. See how difficult it would be to get any kind of decent investment returns without the dividend contribution, let alone outperform.

Dividends are set to dominate equity returns again. Get ready, or get left behind!

About the Author

David Hogarty is Head of Strategy Development, Dividend Plus, at Kleinwort Benson Investors. The firm is an established institutional asset manager with headquarters in Dublin, Ireland. Its primary goal is to offer differentiated and innovative investment strategies which enable investors to generate consistent outperformance with less risk. To this end, Kleinwort Benson Investors is the first manager to develop a diversified (all industries and regions) global equity strategy using a dividend based methodology. This strategy has consistently outperformed the MSCI World Index since its 2003 launch, with less risk and volatility. For more information: www.kbinvestors.com

The views expressed in this article are expressions of opinion only and should not be construed as investment advice. Past performance may not be a reliable guide to future performance and the value of investments may fall as well as rise. Investments denominated in foreign currencies are subject to changes in exchange rates that may have an adverse effect on the value, price or income of the product. Income generated from an investment may fluctuate in accordance with market conditions and taxation arrangements. This material is provided for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase any security or product by Kleinwort Benson Investors Dublin Ltd. Kleinwort Benson Investors Dublin Ltd is regulated by the Central Bank of Ireland and is subject to limited regulation by the Financial Services Authority (FSA) in the UK. Details about the extent of our regulation by the FSA are available from us on request.